Company Deep Dive #4 - VERTIV

Providing power and cooling systems to giant AI clusters

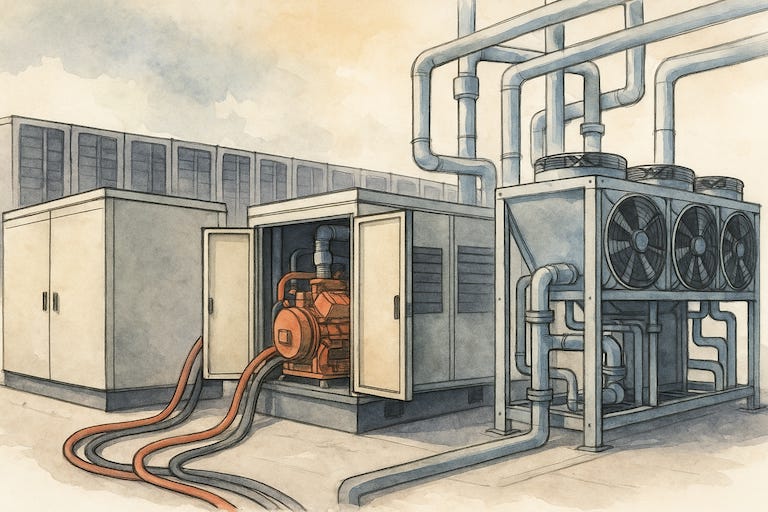

Today we’ll be diving into the company that provides power and cooling systems to giant AI clusters that have been popping up.

1. Why bother with Vertiv?

Vertiv makes the gear that keeps the world’s data centers and telecom networks alive. This includes backup power units, high-capacity cooling, prefab data-center modules, and the service teams who install and maintain them. It sits at the beating heart of the cloud: if servers are the brain, Vertiv is the circulatory and respiratory system.

Over the past two years, Vertiv’s sales have leapt from roughly $8 billion to almost $10 billion. And profits have grown even faster because management squeezed costs and raised prices. At the same time its share price has more than tripled. That dramatic rise leaves investors wondering: Is there still room to run or has the market already banked all the good news?

Our central question is whether Vertiv can keep expanding sales and margins at today’s pace for another 2 years. Long enough to justify the lofty price tag while fending off supply hiccups, tariffs, and an increasingly ambitious set of rivals.

2. The Market Backdrop: Why “Plumbing” Suddenly Matters

Life on the internet is moving toward ever-heavier workloads: gigantic AI models, real-time video, immersive gaming, factory automation, and 5G-powered edge devices. All that digital traffic must be processed, stored, and cooled somewhere. Analysts now peg the market for data-center power and cooling at more than $50 billion a year, expanding close to 10% annually.

A big slice of that growth is tied to “AI mega-campus” projects. A single AI training hall can draw as much power as a small town. That means massive uninterruptible power supplies (UPS), new liquid-cooling systems that look more like radiator circuits than air conditioners, and racks custom-designed to cram more servers into less real estate. Vertiv has spent heavily on R&D in just these areas: bigger UPS cabinets, coolant-distribution units capable of handling kilowatts per rack, and turnkey prefab rooms that arrive on site ready to plug in.

Outside the headline-grabbing AI boom, there are quieter but still powerful growth engines. Telecom operators adding battery-backed power plants to 5G tower sites, hospitals and factories swapping older inefficient power equipment for newer gear to cut energy bills, and emerging markets building first-generation data centers as they digitize. Even if the AI frenzy cooled, these parallel streams provide a wider foundation for Vertiv’s long-term demand.

3. What Vertiv Actually Sells and Why Customers Pay Up

We can think of Vertiv’s catalog in 3 buckets:

Power management. Giant UPS units, precision switchgear, and DC plants deliver clean electricity when the grid flickers.

Thermal management. Traditional chilled-air systems plus newer liquid-cooling rigs siphon heat from servers that would otherwise melt.

Integrated solutions and services. Prefabricated data-center pods, monitoring software, and a 3500-engineer service army that keeps everything running.

Customers are hypersensitive to downtime. Minutes of outage can cost a bank millions in lost trades or a streaming company a wave of angry subscribers. That fear makes reliability and rapid service worth paying for. Vertiv leans on its global service footprint. 200 service depots and decades-old brand names like Liebert to promise peace of mind.

Once a facility is designed around Vertiv gear, it’s really hard to swap them out. It usually involves rewriting blueprints, climbing learning curves, and living through a risky cut-over. Those high switching costs help Vertiv hang on to customers far longer than the typical hardware vendor.

4. Financial Health

Vertiv’s recent numbers read like a turnaround thriller:

Sales: up 33% year-on-year in the latest quarter, thanks mainly to gigantic data-center orders in North America.

Profit margins: roughly 20% now drops to operating profit, up from less than 10% only three years ago.

Cash: free cash flow topped $1 billion dollars last year and management expects even more this year, despite heavier capital spending to open new lines outside tariff-hit regions.

Debt: net leverage is now well under one turn of EBITDA, giving the balance sheet fresh air.

Because demand is strong and service work is recurring, Vertiv’s backlog has ballooned to more than $8 billion. This is about 9 months of sales already spoken for. That backlog is a safety net if orders ever slow.

So what’s the key issue here? Investors have already priced in a lot of perfection. Vertiv shares now sell at more than 30x next year’s estimated earnings. This is richer than older industrial peers like Schneider Electric or Eaton. To keep the multiple aloft, Vertiv must keep growing in the high-teens and nudge margins toward 25%. This is a goal that management has sketched for 2029. Any stumbles like tariffs biting harder, a supplier shortfall, or a pause in cloud spending could compress the valuation quickly.

5. Competitive Landscape: Who Else Wants the Prize?

The power-and-cooling world is an oligopoly. Schneider Electric, Eaton, Legrand, and Huawei all sell similar racks of hardware. Schneider in particular jostles with Vertiv for the global top spot. The difference is focus. Schneider is broader with offerings in mining, smart buildings, general electrification. And Vertiv is laser-focused on digital infrastructure.

New entrants tend to be specialists. A German company building ultra-efficient chillers or a Taiwanese company that makes low-cost rack PDUs. They can win slices of the pie but rarely displace the incumbents across an entire site. Still niche innovators force Vertiv to keep investing. If a startup invents a cooling system that reduces water use by half, hyperscalers might demand it. And Vertiv would need a response.

Huawei looms as the unpredictable wild card. It can undercut prices in markets less sensitive to US trade restrictions, especially in Asia and Africa. That could erode Vertiv’s share in price-centric projects, though many Western customers shy away from Huawei for security reasons.

6. Why Infra Startups Should Care

Vertiv’s fortunes ripple across the infrastructure start-up world in several ways:

Capital Flows. When a public market giant like Vertiv soaks up attention and cash, investors often group the whole critical-infrastructure domain together. A roaring Vertiv share price can buoy sentiment for startups that sell monitoring software, predictive maintenance analytics, edge micro-datacenters, or next-gen cooling fluids. The logic is that if the incumbent is thriving, the ecosystem must be healthy. Conversely if Vertiv disappoints, VCs may turn cautious on smaller companies who ride the same wave.

Channel Dynamics. Many infra startups piggyback on Vertiv’s distribution channels. For example, a young company selling AI-driven battery analytics might standardize its API to plug into Vertiv’s service toolchain. If Vertiv accelerates adoption of such add-ons, the startup gains exposure to hundreds of data center customers overnight. But if Vertiv doubles down on proprietary in-house software, those partner slots could shrink.

Technology Standards. Vertiv’s design choices set de-facto standards. If it pushes a particular liquid-coolant chemistry or rack-level power bus, suppliers of sensors / pumps / coolant filters must follow. Startups that bet on competing standards could be frozen out.

Supply-Chain Dependencies. Vertiv commands vast volumes of batteries, power semiconductors, and copper busbars. A shortage or price spike (like the capacitor crunch of 2021) reverberates downstream. Hardware startups often rely on the same component suppliers but lack Vertiv’s buying power, so they can be squeezed on cost or lead times if Vertiv locks up supply.

Acquirer Appetite. Vertiv has a history of bolt-on buys: switchgear maker E&I, and most recently a high-density rack company. Its healthy cash flows mean more buying power. For venture-backed hardware and software companies, Vertiv could be a natural exit. The better Vertiv’s stock performs, the more coins in its acquisition purse. If the multiple contracts, M&A budgets tighten and exit windows may narrow.

Roughly speaking, half of the infra startups focused on physical data-center technology (e.g. power modules, advanced cooling, microgrids) swim in Vertiv’s lane. They either integrate with Vertiv, compete in a niche, or hope to be bought. A slowdown in Vertiv’s ordering pattern or a stumble in its capacity ramp would ripple through component suppliers and service providers that power these young companies.

7. Risks, Dependencies, and Early Warning Signs

Tariffs and Trade. U.S. tariffs on Chinese-made power gear already shave a couple of percentage points off Vertiv’s margins. If trade friction escalates (e.g. a new tariff tranche on batteries), then the costs will rise again. Startups that depend on the same Chinese contract manufacturers would feel similar pain, perhaps without the leverage to pass cost through.

Cloud CAPEX Cycles. The biggest driver of Vertiv’s recent growth is hyperscale data center spending. Cloud companies tend to feast and then digest. If they declare a digestion phase in late 2025, Vertiv’s order book could deflate. Early warnings: sharp drops in cloud CAPEX guidance, rising vacancy in wholesale colocation, or long-delivery lead times suddenly shortening.

Execution Strain. Vertiv is sprinting to open new capacity outside tariff zones, a complex global shuffle. Any hiccup like factory delays, quality slips, or labor shortages could hurt margins or delay shipments. Watch margin trends, one-off charge announcements, or slipping delivery times reported by customers.

Technology Leapfrogging. Suppose a cooling-tech startup proves its immersion system cuts total energy by 30% at scale. Hyperscalers might skip incremental upgrades and jump directly to the new technology, denting demand for Vertiv’s conventional line. Keep an eye on pilot projects e.g. if multiple cloud operators roll out a startup’s solution in production. That’s a sign of pending disruption.

Interest Rates and Financing. Data center projects are capital intensive. Higher rates raise hurdle returns and can push projects out. A sustained jump in long-term yields might freeze marginal projects, trimming Vertiv’s growth. It would likewise dampen investor appetite for capital-heavy infra startups.

8. Conclusion: A Strong Company at a Fairly Full Price

Vertiv is riding megatrends that look durable: ever-denser compute, the race for AI, and the need to keep digital lights on in every industry. Management has fixed its earlier cost woes, reshaped the supply chain, and built a huge backlog that cushions near-term risk. Cash flow is gushing and debt is tame. And the company still has multiple levers such as bigger service contracts, bolt-on acquisitions, and product refreshes. This will help grow earnings even if topline growth cools.

Yet the market is no longer overlooking Vertiv. After a 300% rally, the stock already bakes in several more years of robust growth and smooth execution. If the AI build-out keeps humming and Vertiv pushes margins to the mid-twenties early, today’s valuation can be justified and perhaps nudged higher. But if hyperscalers tap the brakes or tariffs bite harder, the shares could quickly return to earth.

For infrastructure startups, Vertiv’s trajectory is more than a stock-market curiosity. It shapes investor sentiment, sets technical standards, and dictates parts of the supply chain they rely on. A healthy Vertiv lifts the entire critical-infrastructure ecosystem. A stumble would ripple across component makers, cooling innovators, and service-analytics vendors alike.

9. Bottom line

Vertiv is a high-quality company with strong tailwinds and capable leadership, but its stock trades as if the next two years will unfold without a hitch. That may or may not come to pass.

Investors should weigh their risk tolerance: owning Vertiv now means betting that the AI infrastructure boom lasts longer and runs hotter than the skeptics think. And that the company’s operational tune-up holds under even greater strain. If those bets sound comfortable, stay in the saddle. If not, waiting for a more forgiving entry point might be the wiser move.

If you are getting value from this newsletter, consider subscribing for free and sharing it with 1 infra-curious friend: